A New Front in the Fentanyl Crisis: Disrupting the Chinese Money Laundering Operations Cleaning Cartel Cash

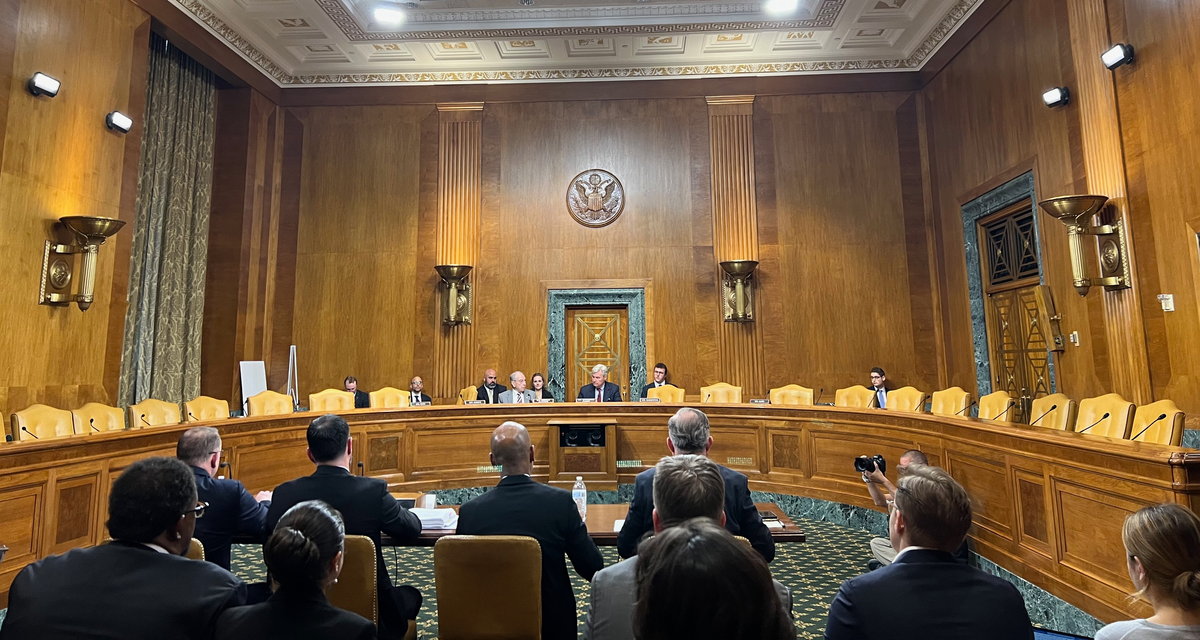

In a recent hearing by the United States Senate Caucus on International Narcotics Control, a critical examination of Chinese money laundering organizations (CMLOs) revealed their significant role in facilitating global drug trafficking, particularly concerning the U.S. fentanyl crisis.

Senate Chairman Sheldon Whitehouse (D-RI), Senate Co-chair Chuck Grassley (R-IA) led the hearing with caucus members and key figures from Homeland Security Investigations (HSI), the U.S. Department of Treasury, the Office of National Drug Control Policy, and the Drug Enforcement Administration. Each witness offered insights into the networks of financial transactions that support the global drug trade. Their testimonies emphasized the necessity of coordinated approaches to dismantle the financial infrastructure that drug cartels rely on.

The hearing underscored the role of regulatory reforms such as the Corporate Transparency Act, which aims to peel back the layers of secrecy afforded by shell corporations, a favored tool of foreign entities involved in money laundering. The discussion also touched on the urgent need for enhanced international cooperation, particularly with China and Mexico, to address these challenges effectively.

Chairman Whitehouse explained, “Fentanyl usually begins in Chinese chemical factories before passing through Mexico on the way to the U.S. It can be made with only a few ingredients, making enforcement efforts difficult.” A kilogram of synthetic opiates like fentanyl, Whitehouse continued, can produce 1 million counterfeit pill dosages.

Homeland Security Investigations Strategic Response

Ricardo Mayoral, Assistant Director for Countering Transnational Organized Crime at Homeland Security Investigations detailed the efficiency of how CMLOs enable drug cartels to exchange dirty money across borders. The financial gymnastics in money laundering involves mirror transfers. In a mirror transfer, the user pays the amount required to be remitted overseas to a local bank controlled by CMLOs, which then arrange for a reciprocal payment, or mirror transfer, to be made to the bank account of a remitters choice. These mirrored swaps enable a rapid back-and-forth transfer of funds across international accounts, bypassing the need for physical cash movement and evading traditional financial oversight.

The People’s Republic of China (PRC) enforces transfer restrictions of $50,000, compelling Chinese citizens and entities to circumvent these rules by tapping into underground networks, which in turn fuels a booming shadow economy. This mechanism not only challenges the global financial regulatory frameworks but also deepens the synthetic opioid crisis in the U.S, where drugs like fentanyl continue to claim lives at an unprecedented scale.

HSI's aggressive strategy includes forming the Cross Border Financial Crime Center to enhance collaboration among U.S. and international law enforcement, banks, and private sector partners, aiming to seal the leaks in the financial system that CMLOs exploit.

According to Mayoral, HSI’s efforts in 2023 resulted in 2,474 arrests 1,579 criminal indictments, 842 convictions, and the seizure of 457 million in illicit currency and other assets. Over the last decade HSI’s El Dorado Financial Crimes Task Force led over 2,100 arrests, and seizure of 2.6 billion in illicit proceeds.

DEA’s Renewed Focus

William Kimbell, Chief of Operations for the Drug Enforcement Administration gave testimony about the daunting toll of drug-related fatalities. "In 2022, drug overdoses claimed the lives of 107,941 Americans, and an estimated 110,000 in 2023,” said Kimbell. According to his estimate, approximately 300 Americans a day die from drug-related causes, with illicit fentanyl involved in nearly 70% of these fatalities, Kimbell continued, “this figure does not include the ones who overdose and are later revived.”

The DEA is ramping up its actions against the Sinaloa and Jalisco cartels, key players in trafficking synthetic opioids into the U.S. These cartels not only supply drugs but also engage in complex money laundering operations involving global trade networks, banks, virtual currencies, and real estate.

Kimbell explained, "The fentanyl supply chain begins with Chinese chemical companies responsible for supplying precursor chemicals to the Sinaloa and Jalisco cartels, money launderers represent the end of the supply chain and allow the entirety of the logistical network to remain profitable and operational."

He also highlighted how these cartels leverage sophisticated networks that integrate into global trade, utilizing both traditional and digital finance methods to launder money. These networks, deeply embedded in metropolitan areas across the U.S., are adept at exploiting regulatory loopholes and adapting to new operational tactics. These networks are incorporated with established worldwide trade entities, including Chinese importers and exports. Chinese money laundering organizations,” said Kimbell, “possess a unique capacity to compartmentalize networks and recruit from within Chinese communities that have expatriated worldwide.

In response, the DEA has formed specialized counter-threat teams focused on the Sinaloa cartel, the Jalisco cartel, and associated financial operations. These teams centralize intelligence from the DEA's 334 global offices to map and disrupt the cartels' networks comprehensively. This strategy has led to significant enforcement successes, including $5.6 billion in asset seizures and 14,000 arrests since 2000, facilitated by partnerships with other agencies and programs like the Attorney General's Exempted Operations Program, which according to a foreign review report, plays a role in the DEA’s ability to conduct undercover investigations in the United States.

The Overdose Crisis and Administration’s Efforts

Kemp L. Chester, from the Office of National Drug Control Policy highlighted the devastating toll of synthetic opioids like fentanyl. “Nearly 49 million Americans, or 17% of our population, currently suffer from a substance use disorder” said Chester.

While traditional structures of street dealing still exist today, Chester highlighted the development of global enterprises with access to vast capital resources that fuel the synthetic opioid production and supply chain, networks that are becoming ingrained in the 21st century global economy and provide funds transfers across borders with speed and efficiency. The synthetic drug market, said Chester, “conducts routine collaboration among raw material suppliers across international borders, uses advanced technology to fund and conduct business, and possesses the capacity for product innovation and strategies to expand markets.” Money laundering organizations based in the PRC have emerged as the utility of choice for Mexican drug trafficking organizations seeking to move these funds through bulk cash smuggling, trade-based money laundering, and the exploitation of financial systems.

The administration's plan in combatting the synthetic opioid crisis is commercial disruption, and in making the flow of fentanyl more costly, more time consuming, and less profitable. In the hearing, the High Intensity Drug Trafficking Areas (HIDTA) Program, which brings multi-jurisdictional task forces together on a state, local, and tribal level, was identified as one of the governments most impactful investments.

In 2023, the Biden-Harris administration launched a strategy for commercial disruption aimed at intensifying the operational and financial challenges for narcotics traffickers, making their activities more costly and less profitable. In seeking cooperation from Beijing, the administration lifted sanctions on the Chinese Ministry of Public Security's Institute of Forensic Science, a move Republican lawmakers decried as weak diplomacy.

Treasury’s Multifaceted Approach

Brian Nelson, Under Secretary for Terrorism and Financial Intelligence at the U.S. Department of Treasury, outlined the departments actions to combat CMLO activities. Treasury's Financial Crimes Enforcement Network (FinCEN) analyzes Bank Secrecy Act data and sanctions from the Office of Foreign Assets Control to share its analysis of trafficking typologies in granular detail with law enforcement, which provides useful lead information to attacking the supply chains for synthetic opioid drug chemical precursors. Treasury also relies on domestic regulatory reforms such as the Corporate Transparency Act, which took effect in January 2024, and requires a broad range of entities to report information to FinCEN about the individuals who ultimately own or control them.

Treasury also facilitates international engagement with the PRC through a counternarcotics working group. In April, Secretary Yellen established a joint treasury People’s Bank of China cooperation and exchange on anti-money laundering to enable the sharing of information and address illicit financial activity within the two financial systems. In the hearing, Senator Grassley drew scrutiny to the information being shared with China, indicating concerns on China’s ability to understand how U.S. systems work without the U.S. fully understanding how China’s systems work.

The Select Committee On The CCP: The CCP’s Role In The Fentanyl Crisis

During the hearing, Senator Maggie Hassan (D-NH) cited an investigation from the House China Select Committee, which reports how the Chinese government inadvertently grants tax rebates to producers of fentanyl analogues and precursors, effectively bolstering the flow of fentanyl into the U.S. The report shows the PRC owns interests in firms linked to drug trafficking and does not effectively prosecute manufacturers of fentanyl and its precursors. Instead, it allows the sale of these substances on heavily monitored Chinese internet platforms without fear of prosecution, selectively censoring domestic drug content while ignoring export-focused narcotics operations. This governmental support of the narcotics trade not only undermines international law but also strategically benefits China economically, empowering its position in global money laundering and chemical industries while exacerbating the fentanyl crisis abroad.

Senator Hassan questioned whether this could be considered as material support for the international fentanyl trade and explored what sanctions the U.S. Treasury might impose to curb the Chinese government's role in subsidizing synthetic opioid production.

The Way Forward: Strategic Measures and Global Cooperation

As the U.S. confronts the relentless threat of synthetic opioids, the Senate hearing provides a critical forum to discuss proposed strategic responses which include, enhancing U.S. enforcement frameworks that foster strong international collaborations, particularly with China. Central to these efforts is the initiation of a cross-border financial crime center within Homeland Security, aimed at bolstering federal efforts and facilitating international information sharing as well as the establishment of the Corporate Transparency Act and the ongoing U.S/PRC Counter Narcotics Working Group to dismantle the financial underpinnings of the Jalisco and Sinaloa drug cartels. This comprehensive approach, combines law enforcement, regulatory reforms, and international diplomacy, and seeks to undermine the economic engines driving the fentanyl epidemic, offering a beacon of hope in a complex battle.

Comments ()